White Hat Bond ETFs: F/m & LifeX Get It Right

Brilliant, Useful, Boring & Forgettable. Thank Goodness.

Every week, it feels like another ETF launches that makes me feel like I should be filing a whistleblower report. Honestly, it's exhausting. And disheartening. I try to be a positive person, but I don't control what happens in the world — I just write about it.

So let’s take a break.

Let’s step away from the ETFs you should absolutely not buy, and the ones that quietly don’t deliver while collecting fees. Today, I want to highlight the most boring corner of the market, because it's where actual innovation seems to be happening: nearly-passive bonds.

Here’s the quote:

"For years, the ETF industry has been a race between innovation and obfuscation. Somewhere along the way, we stopped asking if products were designed for investors or for marketing decks. But in the quiet corners of fixed income — where there's no hype and no leverage — folks like F/m Investments and LifeX are quietly rebuilding trust, one coupon payment at a time."

— Dave Nadig, Independent ETF Expert

Today I want to highlight two firms that are pushing the envelope in thoughtful, white-hat directions: F/m Investments and LifeX by Stone Ridge,

IMPORTANT NOTE: I am not currently compensated by these (or any other) ETF firms in any way. That's the point of being independent (please subscribe!). If that changes, I'll be loud about it.

Boring Bonds Made Boringer

We've had super-boring bond ETFs for a while now. In 2010 the first BulletShares ETFs were launched by Claymore (which became Guggenheim Investments, which became Invesco by 2018). These aren't bond-ladders so much as bond-rungs: each ETF holds either Investment Grade, Junk, or Muni bonds all maturing in the same year. So, for example, you could buy BSCY, and get a bunch of AT&T and META bonds all coming due in 2034. And because all the maturities are matched, you can hold BSCY and feel pretty darned confident that between now and then, you'll receive the "Yield to Maturity" of 5.48%, and eventually, in 2034, you'll get all your principal back, assuming no defaults.

These are good white hat products if that pattern of returns matches your need — like, say, you want to buy a fancy car or a year of law school in 10 years. You could put $100k in BSCY, and while there’s SOME risk you might loose some money in a rash of defaults, most likely, you’ll get about $5,000 a year in dividends, and then your $100,000 back at the end. These are successful, good-idea products, and between them, BulletShares and the comparable products from BlackRock and State Street have a combined $57 billion in 94 funds.

But, based on where the assets are, most folks are using these for making big bets on, say, the short end of the corporate bond curve, not building long term income portfolios. (The top ten by size are all corporate bond versions maturing in the next few years.)

F/m Investments: Better (Still Boring) Rungs

In 2022, boutique bond manager F/m Investments (who also run the Oakhurst mutual funds), came out with Benchmark Series: one of the only lineups of ETFs that's easiest to explain with a picture.

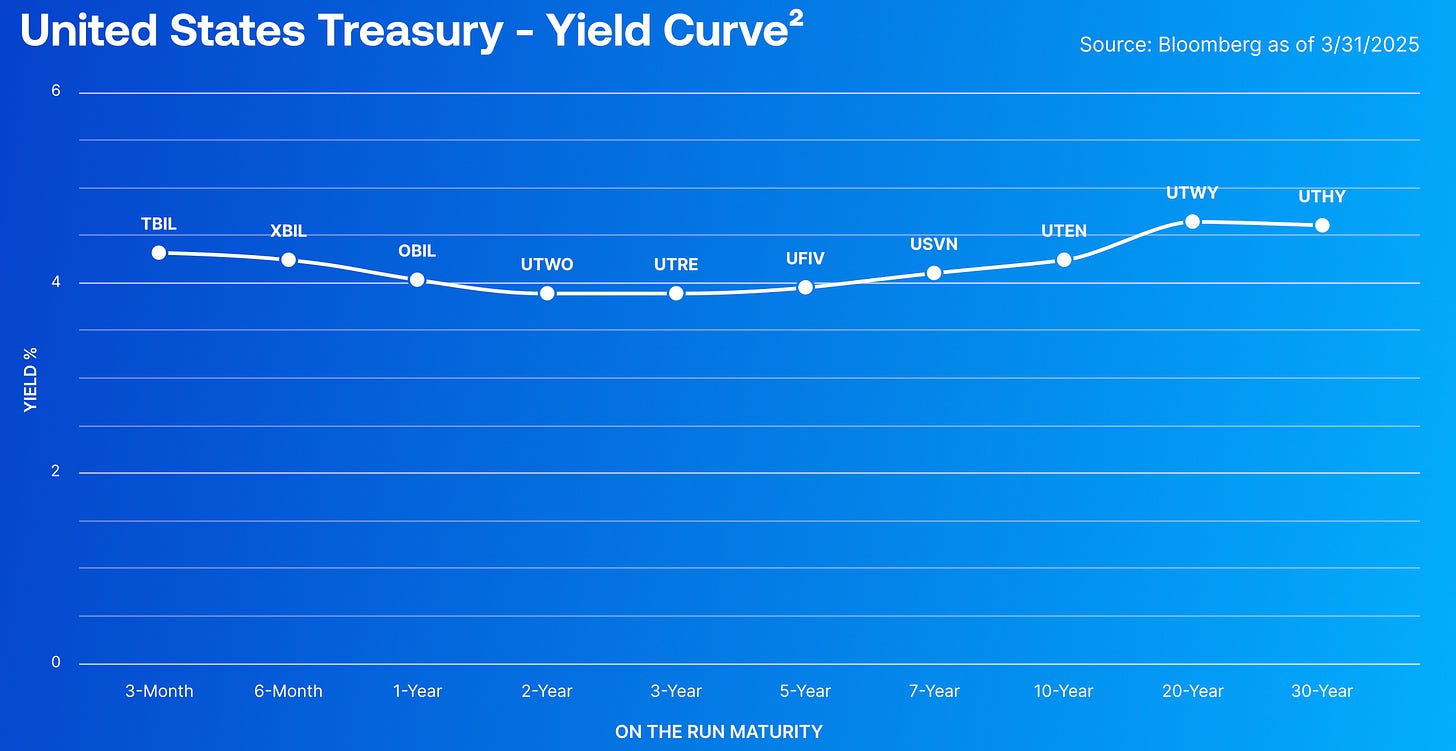

Each fund owns the on-the-run Treasury for the appropriate bucket — that is, the most recently issued, highest-liquidity bond(s) that make up the index of bond(s) people mean when they talk about "the yield curve."

It seems nuts now, but until these folks launched, if someone said they wanted to "play the 2s and 10s", how they might be making that trade was open for debate. Futures? Cash bonds? A swap contract?

Now you just buy or short UTWO and UTEN. Honestly it's one of those product suites I am genuinely annoyed I didn't think of for the 25 years we've had Bond ETFs. They only charge 0.15%, which — given they actually have to trade these things to keep the maturities pure — is fine.

Of course that’s not all the issuer does. They just launched a 1–13 month TIPS product (RBIL), which I suspect will be quite popular, and a set of 2-, 3-, and 10-year Investment Grade Corporate Bond ETFs, with, you guessed it, constant 2-, 3-, and 10-year maturities. Most recently, they launched ZTOP which — ignoring the fantastic ticker

— tracks the Bloomberg U.S. High Yield Top 100 Quality Select Equal Weighted Index. That much less fantastic index name is actually a fantastic methodology: it only invests in the largest, most liquid garbage bonds, and equal weights them. That's not sexy. It is honest.

I can't vouch for how well the bond markets are going to do. What I can say is this is a clever-yet-boring approach to bond portfolio building blocks.

White Hat is Simplicity as a Service.

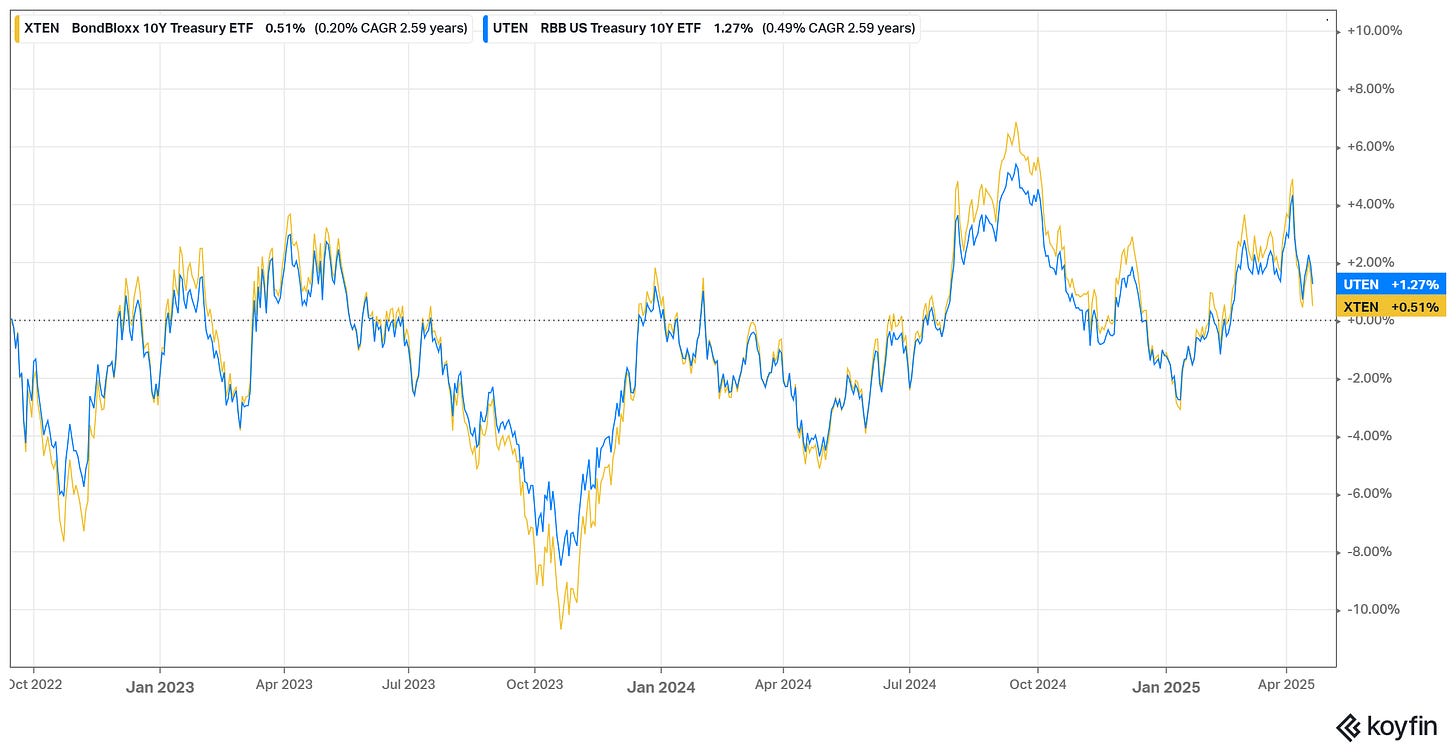

Sidebar: BondBloxx (itself an interesting player for future discussion), has a series that looks like these, but aren’t. Their versions manage each fund to maintain a constant duration (rather than specifically targeting the on-the-run liquid bond. So while UTEN has 1 bond inside right now (The 2/15/35 Treasury), XTEN (the BondBloxx version) owns dozens of bonds that average out to a ten-year duration.

The results aren’t bad, necessarily, they’re just different. In every case I looked at, the F/m version is simply a tighter, lower beta version of the same pattern of returns.

LifeX by Stone Ridge: Bringing Not-so-Sexy Back

All of the above products let the enterprising investor build bond portfolios. And there is no bond portfolio less sexy than a bond ladder:

A bond ladder is just a string of individual bonds all maturing over the next however long. So, a simple bond ladder might be 10 Treasuries ranging from 1 year out to 10. If you intend to hold the bonds till each matures, this ensures a stream of entirely predictable cashflows from semi-annual coupon payments and yearly principal repayments.

It is truly "fixed income" (unless the U.S. defaults), and for that reason it used to be a go-to strategy for financial advisory clients in retirement.

A lot of advisors still ladder bonds or even CDs for some clients when they have really predictable cash needs, but LifeX makes that pointless now.

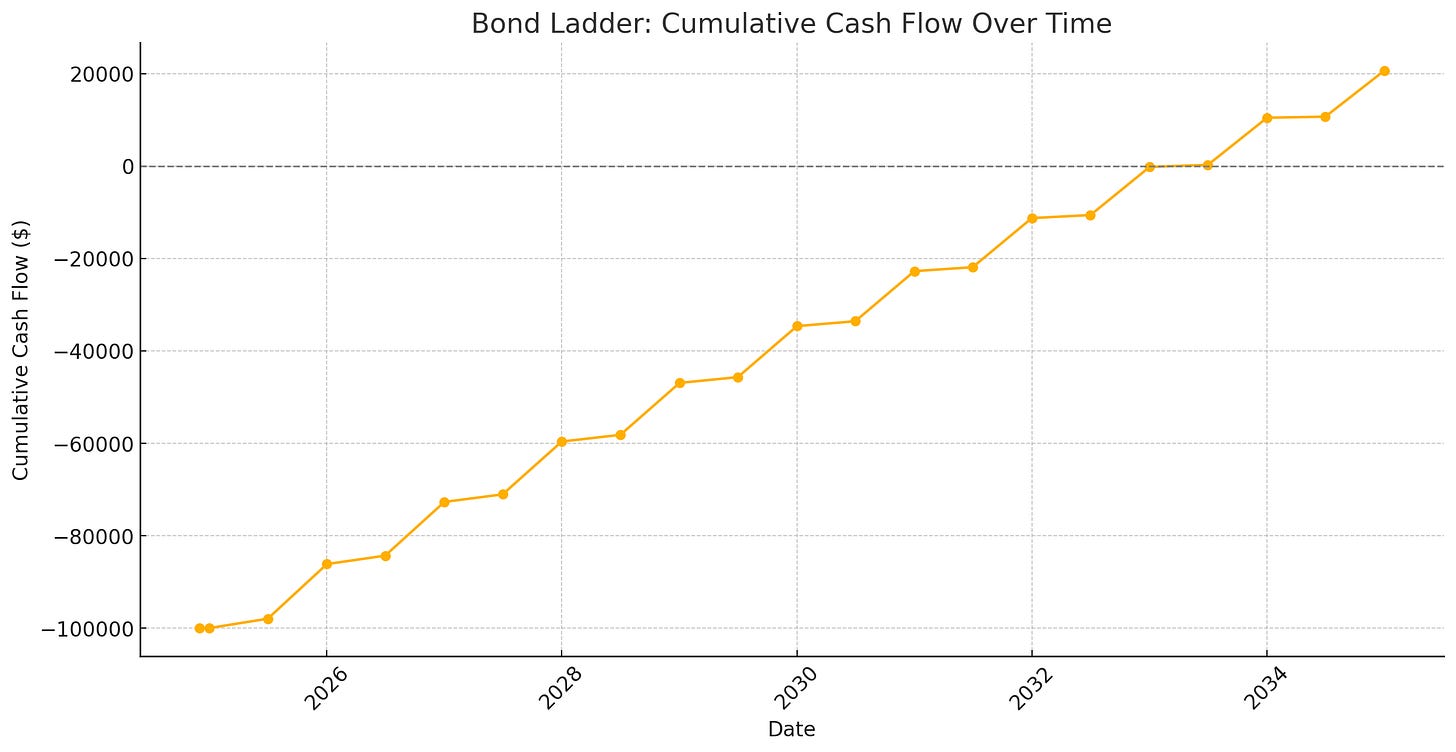

Each LifeX fund has a maturity year. Each portfolio is designed to hold a ladder of bonds, but instead of semi-annual coupon payments and annual principal return, LifeX distributes both income and principal every month.

The simplest versions pay literally the exact same dollar amount every month until the fund’s due date.

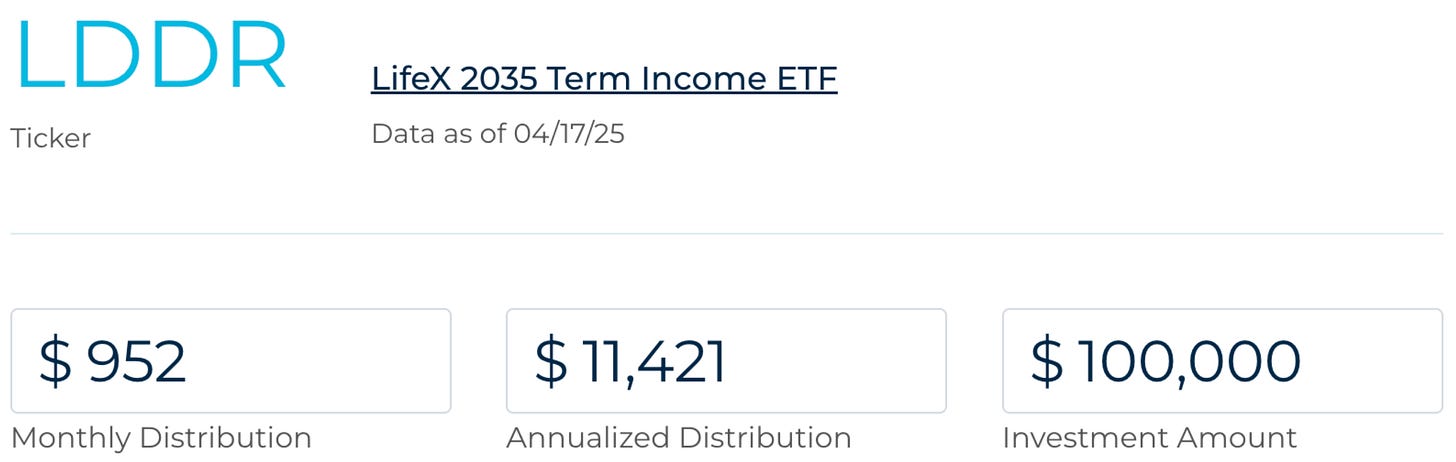

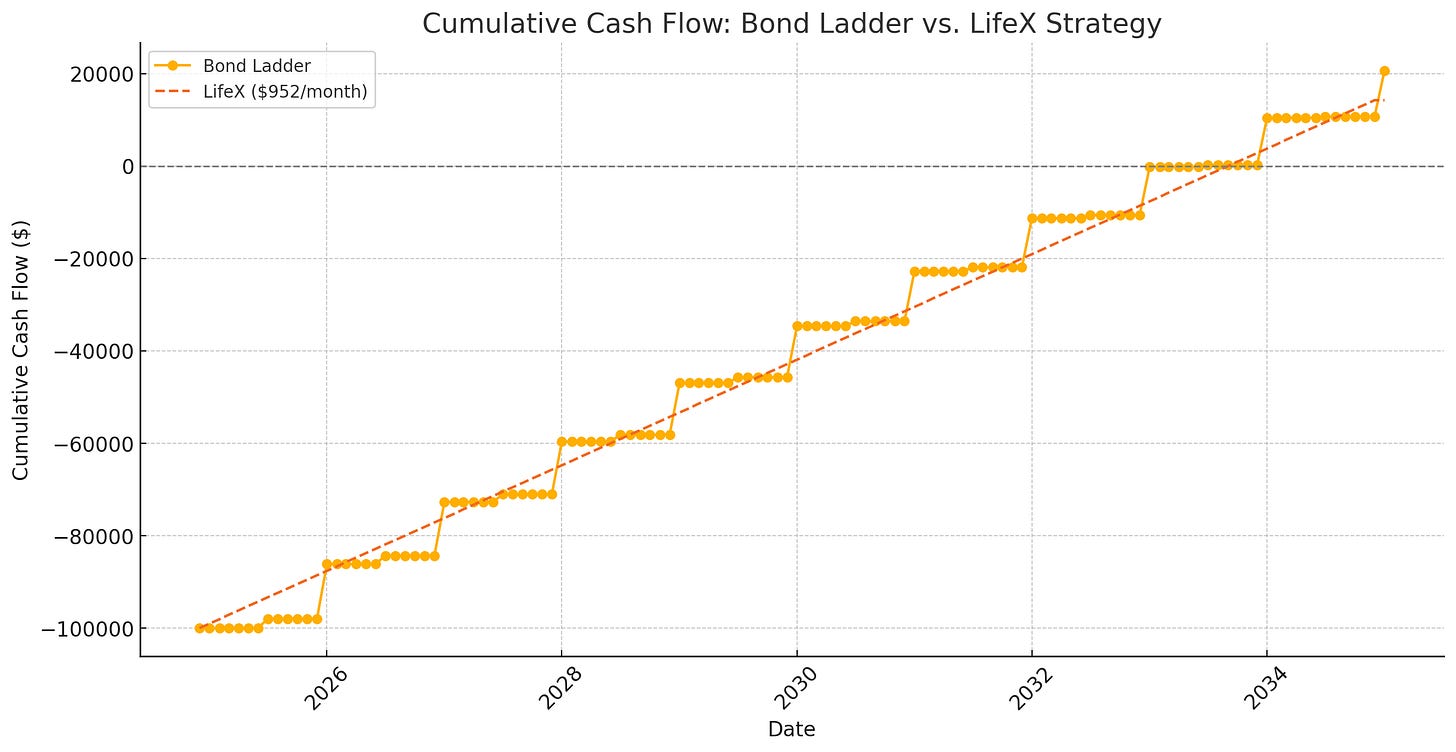

For example: at today’s levels, a $100,000 investment in LifeX’s 2035 Term Income ETF (LDDR — the largest of these) throws off $952 per month — an annualized distribution of $11,421. That’s an 11.4% distribution yield (not your total return). You’re getting paid your principal back over time instead of in once a year chunks. So, visually…

… it’s pretty obvious that what we’re really doing is smoothing the investor’s ride. We’re adding a level of even-greater predictability (and a huge slug of simplicity and efficiency) to the already useful bond ladder.

Sidebar: Not all of LIfeX funds are just like this. Longer-dated "Lifetime Income" versions front-load the payouts on the theory that many retirees' cash needs drop a bit over the long term (say, if you're buying the 2048 version). They also offer one non-dated ETF (LFDR) that makes annually-reset, level monthly distributions on a more traditional perpetual portfolio — currently distributing over 5%, with 30% from return of capital, about which I have no real opinion.

White Hat is honest, useful complexity that serves investors, rather than confusing them. There’s no leverage. No magic yield math. Just a straightforward promise: buy this, and it will pay you back, month by month, until it stops. If you die, your heirs get what’s left and a nice step-up in basis to boot from the Return of Capital.

I'm not suggesting that a return-of-capital embedded bond ladder is a magic bullet, but it absolutely does solve a real problem that real human beings have — and at the pretty-darn-reasonable price of 0.25% on average.

White Hat is Boring and Forgetful

Jack Bogle, Vanguard's patron-saint of rational investors, once told me in a green room that "Sometimes boring and forgetful is the best thing you can be."

I think Saint Jack would approve of these folks making boring, well-made products investors can feel confident forgetting about.

Really useful. Thank you.

Thanks Dave. Refreshing to know that there are still good people doing new white hat work in the ETF space.

Btw. Is there a better alternative to BOXX for the part of one’s portfolio where we want short term treasury yields but treated as cap gains rather than current income?