SHIFT: Burpees & Groupies in Rivendell

A Journey to Wealth Management's Sacred Forest

I am somewhere around Orlando on the edge of the paved Disney wasteland when the panic begins to take hold.

The crusty and often misplaced Apple airpods drown out the Uber’s AM radio blasting non-stop political theater. I’m listening to the new drop from SanFran band/dude/indie legend “The Reds, Pinks & Purples.”

What’s going on with ordinary people?

What’s gotten in their thoughts these days?

There’s something gone wrong with ordinary people,

What’s behind the pleasure and the pain.

A song of the now if ever there was one. I’ve spent the past few months having lots of longer-than-usual one-on-one conversations with people I know and trust who are smarter than me (which is all the people I know and trust), and this is the Zeitgeist: Dis-ease. A sense of impending doom. Helplessness. On the AM radio preferred by the geriatric Trumper driving me to feed the mouse the green cheese. On my headphones from left-coast DIY music makers. Dis-ease.

Why the hell am I in Orlando?

While I appreciate Disneyana (hell I got married here!) there’s an enormous difference between being in the artificial DisneyMagic bubble with a companion, and the hellscape paved wasteland surrounding it. And yet here I am crashing a conference I have no cash-money reason to attend.

What’s SHIFT?

SHIFT’s tagline is “Human First Financial Guidance” (TM!) , and it is, as far as I can figure out, the brainchild of Ross Marino, a delightful CFP who hosts the event and is kind enough to give me a “media” pass because he doesn’t ask enough questions.

As he describes it:

This is its second year, and I knew a few folks who went last year and raved about it. “Like putting on a show in the barn with pews borrowed from the church,” was how one attendee described it.

The core idea is pretty simple: the business of managing money, from the way we run companies, to how we invest in those companies, to how we talk to individuals and institutions about their money, has become as Left-Brain locked as the rest of the modern world. The particularly American gradient of money-management-energy is probably a doom-accelerant all is own. So maybe there are better ways? A “wholer” way?

I’ll try again: It’s kind of a weird tribe of folks trying to do a bit more than make their clients numbers go up. Because that’s like, the human thing to do? Not because it sells.

Toolmakers vs. Mapmakers

“I don’t even know why I’m going to this thing,” I say from the back seat of the Uber, connected through the astral-iPhone cord of RF frequencies to Brian Portnoy, founder of Shaping Wealth and a kind of patron saint in this “Human First” … thing, absent the (tm!).

“I think it’s great!” he says, genetically enthusiastic for people to think even a little more deeply about things. “You’re basically an anthropologist visiting a foreign land!”

The reality of my career is that while I’ve been on the fringes of “wealth management” for decades, it’s largely been because it was obvious to me that that’s where the levers of power are. You wanna change the world? You change the thinking of the people with all the power.

But what I’ve mostly been paid for is explaining the tools of investing to this tribe of influencers. If you want to understand how market structure, regulatory shifts, academic research or capital flows impact your product selection, trading strategy or potential solution set, I’ve been your guy.

In a world full of mechanics, I am a toolmaker and engineer, or at least I write decent technical manuals. That’s most of the investment management “industry”: lots of how, very little why. This “foreign” land was devoid of toolmakers. Not an asset manager to be found on the agenda. Not a portfolio review or technology platform in the mix.

Instead, every person on the agenda had a similar goal: to help financial advisors become guides and wayfinders — experts at navigating the subtleties of a natural landscape full of life and humanity, that just happens to intersect with the sharp edges and hard corners of markets and capitalist economics. The folks at the center of attention here are the mapmakers. The lion-trackers. Openers of the way.

In January, Orion’s Daniel Crosby asked if Advisors were becoming coaches. I’m here to find out.

Burpees at Dawn

I know only a dozen folks, perhaps, on the attendee list. One of them is Jess Bost from Alpha Architect. I don’t know her well, but she regularly runs yoga and HIIT workouts at financial conferences, and we’re at least Twitter-friends, so I make a point of going to her 630AM workout that kicks off the conference.

I walk out the hotel door into the grass that edges a faux-Disney lagoon. It is pitch black. It’s 50 degrees. It’s raining. It’s windy. There is not enough coffee. There couldn’t be.

“Grab a mat and let’s get going!” shouts Jess over the wind, to the 20 or so of us arrayed, dazed, in the sandy turf. “It’s cold, it’s a little windy, and we don’t have a speaker, so we’re stacking Burpees and V-Ups!”

For half an hour, she shouts encouragement over the wind in the palm trees. “Your health journey is just like any other journey … showing up is where it starts.” Exuding authentic enthusiasm, offering her time and expertise and inhuman 6AM positivity as a gift, the time passes quickly, and she hands out smiles and hi-5s as we collect our sweaty-rainy mats.

The health-wealth connection isn’t a new idea — Phil Pearlman has built a whole business out of it. But it’s easy to dismiss as “not worth anything.” But looking around, catching a few faces in the dawn light, there’s a decided sense of community amongst people who are mostly strangers. A sense of feeling ever so slightly bad-ass as a group for a moment. Just a little too cold.

That’s worth something.

Gregarious Groupies

“I want everyone to turn to your left or right and talk about a difficult conversation you’ve had with a client recently!”

The woman on stage is Susan Bradley, who’s been working with advisors on how to be more human with their clients for (apparently) over two decades, through an organization called the “Sudden Money Institute.” While I am not her target audience, I know the forms, and she is good at her job.

She explains how to be an empathetic human being in a genuinely engaging way, the same way I might talk about Reg NMS or Rule 6C11: with eye-contact, depth, and real understanding of her audience.

When she turns to the room of perhaps 200 advisors and suggests they pair off, everyone does.

In what was just a moment ago a nice quiet room where I could observe and take notes, 100 energetic and gregarious people start talking. With enthusiasm. The pair to my right starts talking about how they’d each handled a major client’s divorce. To my left, a millennial women talks about “the widow conversation.”

All around me it’s clear this is a cacophonous subculture all it’s own. Many of them know each other, clearly, and even the newcomers all share catch phrases and shorthand about people’s money stories and transition strategies and …

I panic and leave the room, palms sweaty (mom’s spaghetti).

For me, pairing off for role-play or a little instant sharing in the midst of a larger group is more uncomfortable than being strapped to an anthill. It’s one of the reasons I essentially never attend any event where I don’t have some sort of “role.” Crowds and group dynamics are mysterious and unapproachable and laden with anxiety.

But as I leave the session, I look back over my shoulder and recognize the vibe: these folks aren’t businesspeople getting CE credits or networking. They’re me at a nerd convention. They’re Nerds in the best sense — they care *deeply* about something that not everyone else gets. They aren’t here out of obligation, they’re practically on pilgrimage. Their groupies for the voices of this “better way.”

Luckily I brought Zines.

85bb65 - the Zine

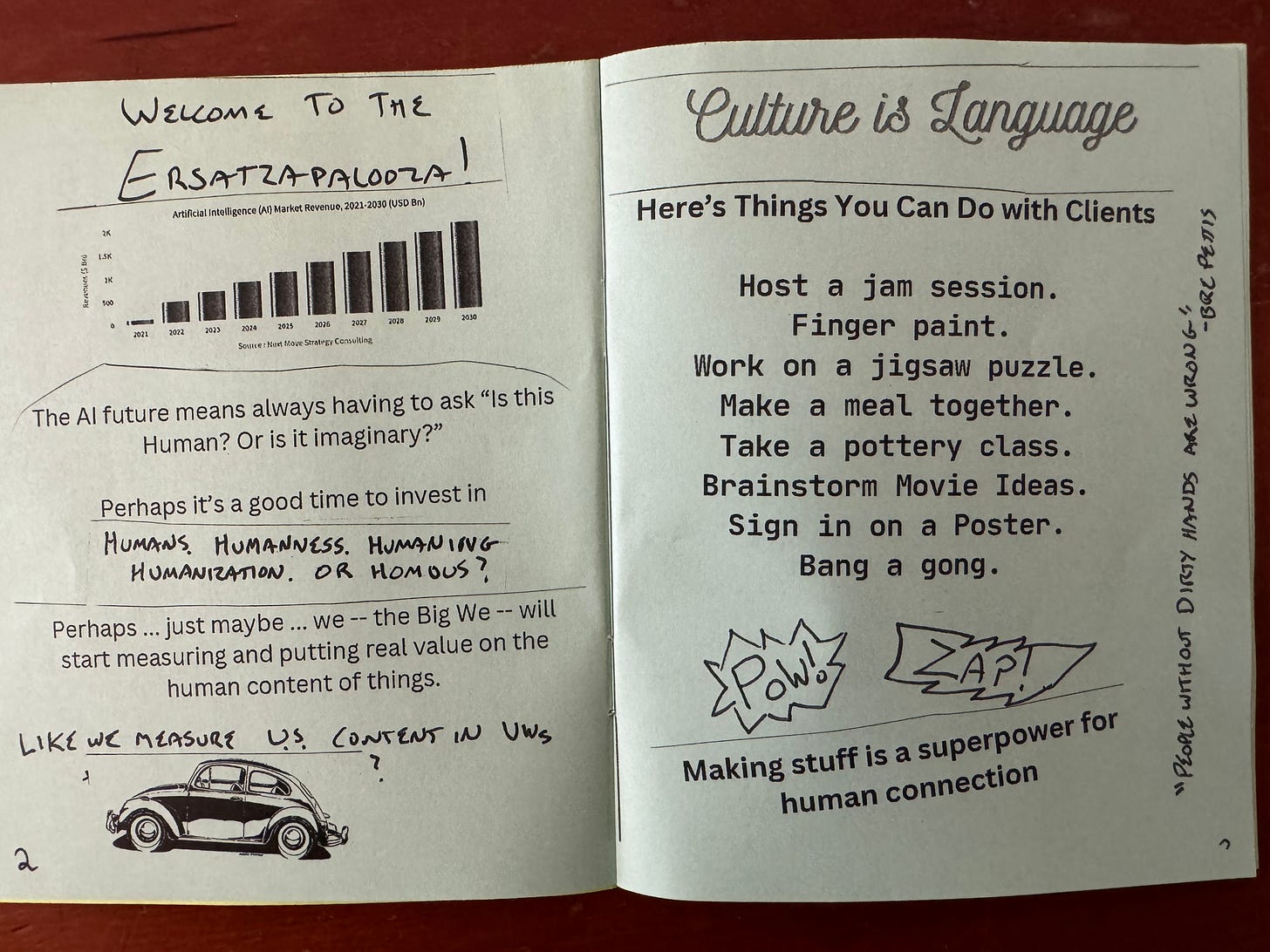

As part of my thinking about the Bullshitification of everything, human disconnection, deaths of despair and the ravine facing Western Democratic Capitalism, I made a choice a bit ago to step off the digital page and go back to making print at least once a month. Specifically, 20-page Zines in runs of 100 to send to friends and colleagues.

Part collage, part DIY publishing, part anti-tech rebellion, it’s a form I love, and one which drove me through SciFi, Punk Rock, Games, Skateboarding and virtually every subculture of my young life.

So I made one about what I thought SHIFT was going to be about, asking questions about human connection in the business of finance, and generally being an idiot out loud (signature move). I made 60 copies, asked a few survey questions in the back, and put my own address and a stamp on the cover. I’ve gotten a few back, we’ll see how many make it home to Massachusetts.

But mostly, in the moment, it self-defines a role. I’m the weirdo handing out copies of Zines to strangers at breakfast. By day two the little yellow-green pamphlets litter the main room. Occasionally someone picks one up and flips through it for a few minutes. Sometimes they pocket it. Sometimes they leave it on the table.

The bell curve of reactions to me doing something weird is always the same: 80% ambivalence, 10% “are you OK?” wellness checks, and 10% “Wow, this is cool.” It’s bait on a tribal-lure, and the nibbles come. A dozen folks make a point of talking to me about this weird thing, and the weird ideas on the green paper.

It’s not much, but it’s enough to make me feel, at least temporarily, like I can be in the space without the ants climbing out from my skin.

Leaving Rivendell

I’d love to report that after 48 hours with a few hundred folks talking a bit differently about the business of financial advice, that I have seen the future… that I can financial-futurize a wave sweeping the nation, reinventing our collective relationship with money.

But sitting in Orlando airport, delayed and drained of color and life by the ever-present concrete and glass and commerce, it’s hard to believe that’s true. I don’t feel like I have seen a movement, so much as visited someplace warm and safe and full of light.

As Neil Bage from Shaping Wealth concluded one of the best 40 minutes I’ve ever seen (gamer know game) on their “Playbook for Human Advice” it hit me that I felt like Sam Gamgee in Rivendell listening to Gandalf. I was visiting a place that was not my home, where people much smarter than I am were discussing matters of great good and import, while outside the forest edges Sauron mounted his campaign of desecration.

Rivendell. Andelain. The Cedars of Lebanon, The Wood Between the Worlds, The Inn of the Last Home, Milliways. The Tabard Inn. Pick your place of solace, magic and new beginnings.

While I was mostly a wallflower, SHIFT was a Sacred Forest of respite for people who are trying to do this job — which is so often about taxes and money and Moloch and ego and fear — like human beings and therapists and confidants and shaman.

While the average SHIFT attendee is probably not on track to sell for $500 million down the line, or end up on the Barron’s Top 100, I do think that they're changing the world. Because they're actually having the real conversations with their clients about what's important, about what matters and about what gives life meaning.

Maybe that’s non economic, but in the face of what’s going on outside the sacred forest, perhaps they’ve found a better way.

Are you feeling better, or are you down again.

What’s going on with everyday people

Riding on a carousel

I’m pretty sure it’s evil, might be sent from hell

But, look at all the people here, I hope it’s going well.