Cheap, Fat & Starving for Attention: ETFs Q1 2025

The Launches will Continue Until Morale Improves

Welcome to the first edition of my regular coverage of the ETF market, targeted at investors, advisors and industry nerds. (READ HERE about why you should subscribe).

ETF Flows are good for understanding what actual investors are doing with their money.

ETF Launches tell you what everyone is trying to sell you (and not much else).

ETF Nerdery is where I’ll cover changes in market structure, regulation and enforcement that might actually matter.

I’ll cover each in detail below. Note: this is a reference post, it’s long and has lots of data in it, and the free preview will cut off after flows.

ETF Flows

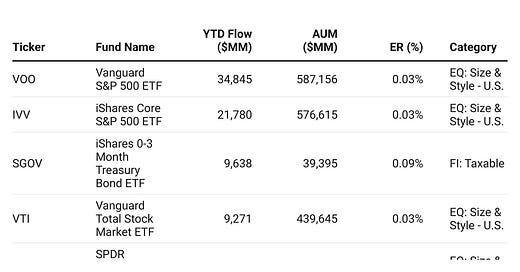

Year to date — a reasonable window to look at flows, not the weekly chaos everyone pushes — the flows are wildly indicative of investors doing the right thing. YTD flows are net $305B — an incredible run rate that would generate the best year ever if it continues. But this isn’t going where you might think it is. The top 10 asset gatherers are generally boring as dirt:

And what do most of these have in common? They’re still incredibly, stupidly cheap, and they brought in a full third of all new assets. To me the big outlier here is JAAA — apparently CLO’s are a thing in ETFs now, and CDO’s are on their way, thanks to BondBloxx. I cannot sigh hard enough.

The Split here by broad category of fund (a composite categorization from our friends over at ETF Action), things also look pretty boring:

Although the $10 billion into Single Stock equities is… annoying. The entire bucket of “single stock” etfs are, to me, black hat. They’re designed to be used by daytraders and gamblers, and being the hand-wringing concern-monkey I am, I worry.

Cheap is still winning, although it’s worth noting that expensive funds — call it anything over 50bps, did get some flows - about $35 billion, or just over 10%.

Active continues to make inroads — in some places. Across these top ten asset gathering buckets, 27% of the flows are active — that’s actually a lot, compared to the historical average of None. But even more interesting, there are now whole categories of funds where Active completely dominates:

Some of this is obvious (essentially all of the leveraged/inverse/buffered world is actively managed), but it’s worth noting that even in places where passive has held sway, like Bank Loans or in this narrow case, Ex-U.S. Small cap, passive is being actively sold in favor of, well, active alternatives.

Which brings us to…

ETF Launches

Keep reading with a 7-day free trial

Subscribe to Nadig.com to keep reading this post and get 7 days of free access to the full post archives.